Your Journey To

Excellent Credit

Starts Here!

Let Us Take Care Of Your Credit,

So It Can Take Care Of You!

Partner with us

Your Partner in Securing a Better Future

We help you improve your credit and work step by step with you to accomplish your financial goals.

BUYING A NEW HOME

Don’t allow your credit profile to stop you from achieving a major milestone.

FINANCING A VEHICLE

Put an end to car dealers exploiting you with exorbitant interest rates and predatory loans.

SECURING BUSINESS CAPITAL

Build the credit foundation to access loans, lines, and capital with ease.

CAREER ADVANCEMENTS

Approximately over 50% of employer background screenings include credit/financial checks.

+1,000

Items Repaired or Removed

+650K

Debt Removed

+98%

Of Clients See Changes in 90 Days

The Credit Restoration process

OUR CREDIT SOLUTIONS PACKAGES

We're committed to Your Credit Success!

Access Our Expertise at a Competitive Cost!

Standard Package

Resoration with Personalized Financial Advise

Gold Package

Standard with Speed

Platinum Package

Change Your Life in 6 Months

6+ Full Rounds of Disputes to Experian, TransUnion & Equifax

90-day Money Back Guarantee*

Personalized Senior Client Advisor

Secure 24/7 Client Portal Access

And More

6+ Full Rounds of Disputes to Experian, TransUnion & Equifax

90-day Money Back Guarantee*

Secure 24/7 Client Portal Access

Credit Monitoring Included

Expedited Credit Repair Services

+2 High Limit Tradeline Credit Cards!

And More

6+ Full Rounds of Disputes to Experian, TransUnion & Equifax

90-day Money Back Guarantee*

Secure 24/7 Client Portal Access

Credit Monitoring Included

Expedited Credit Repair Services

+2 High Limit Tradeline Credit Cards!

+3 Year Aged Corporation Included

And More

OUR CREDIT SOLUTIONS PACKAGES

We're committed to Your Credit Success!

Access Our Expertise at a Competitive Cost!

Standard Package

Repair with Personalized Financial Advise

6+ Full Rounds of Disputes to Experian, TransUnion & Equifax

90-day Money Back Guarantee*

Personalized Senior Client Advisor

Secure 24/7 Client Portal Access

And More

Gold Package

Standard with Speed

6+ Full Rounds of Disputes to Experian, TransUnion & Equifax

90-day Money Back Guarantee*

Secure 24/7 Client Portal Access

Credit Monitoring Included

Expedited Credit Repair Services

+2 High Limit Tradeline Credit Cards!

And More

Platinum Package

Change Your Life in 6 Months

6+ Full Rounds of Disputes to Experian, TransUnion & Equifax

90-day Money Back Guarantee*

Secure 24/7 Client Portal Access

Credit Monitoring Included

Expedited Credit Repair Services

+2 High Limit Tradeline Credit Cards!

+3 Year Aged Corporation Included

And More

Why Choose Us

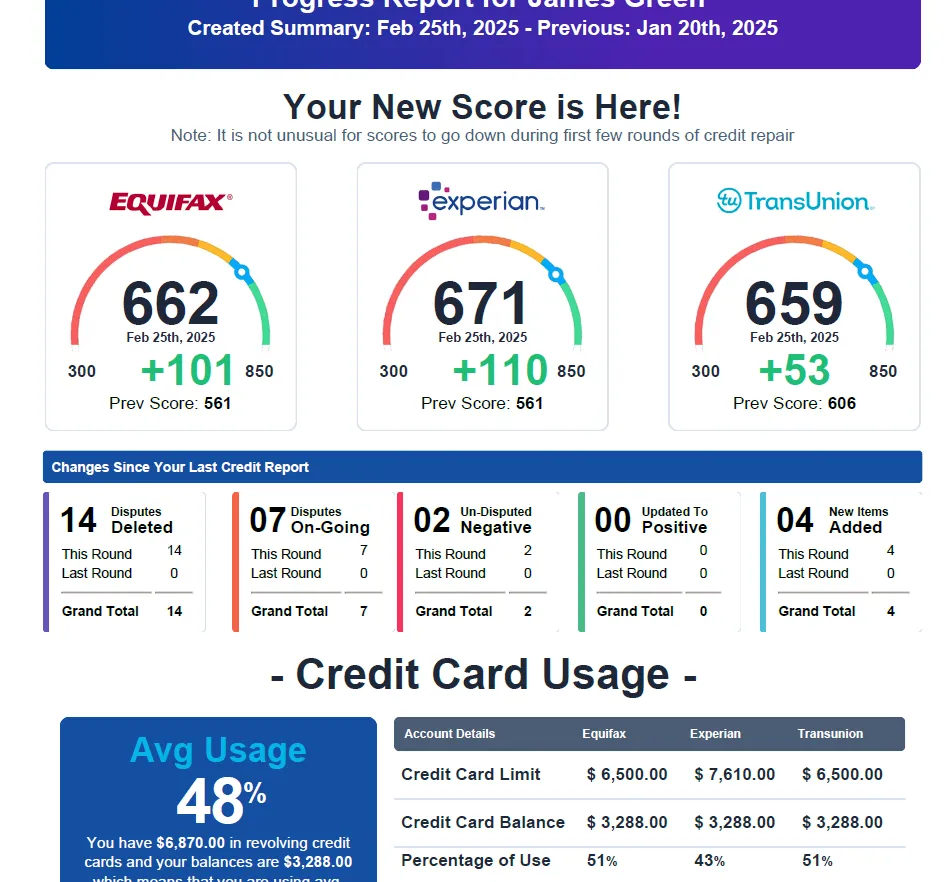

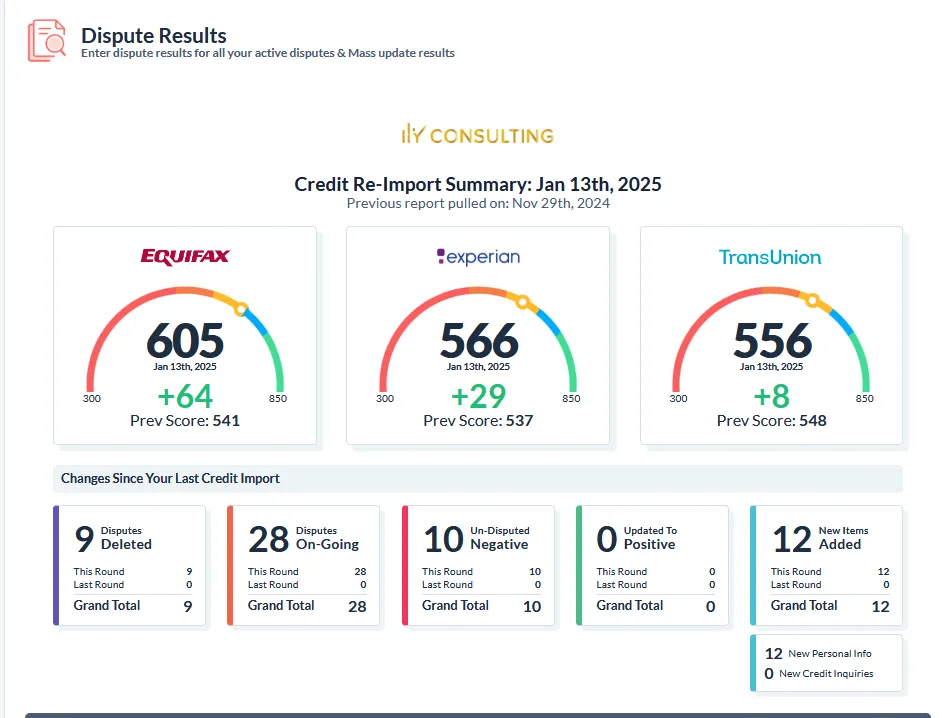

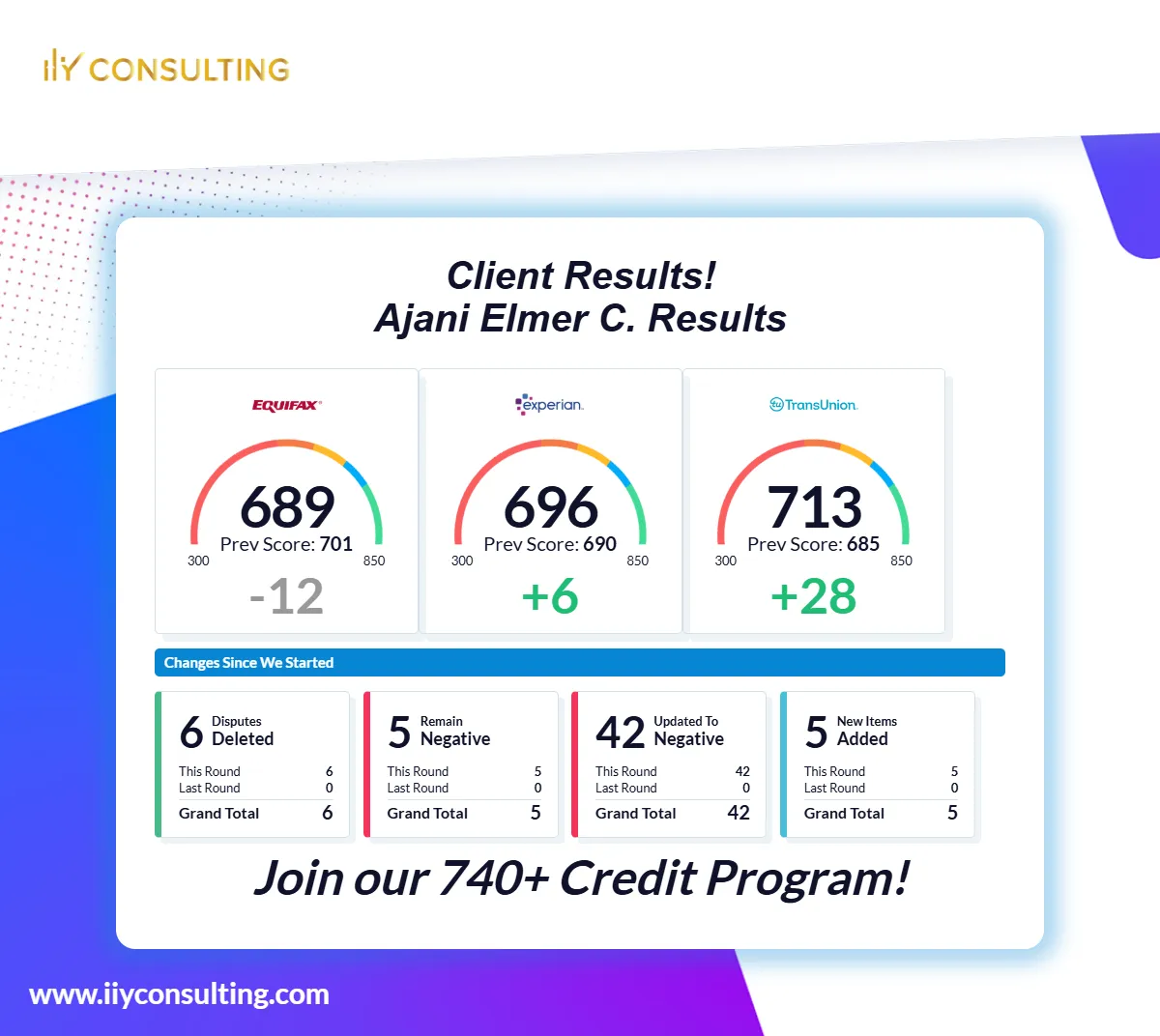

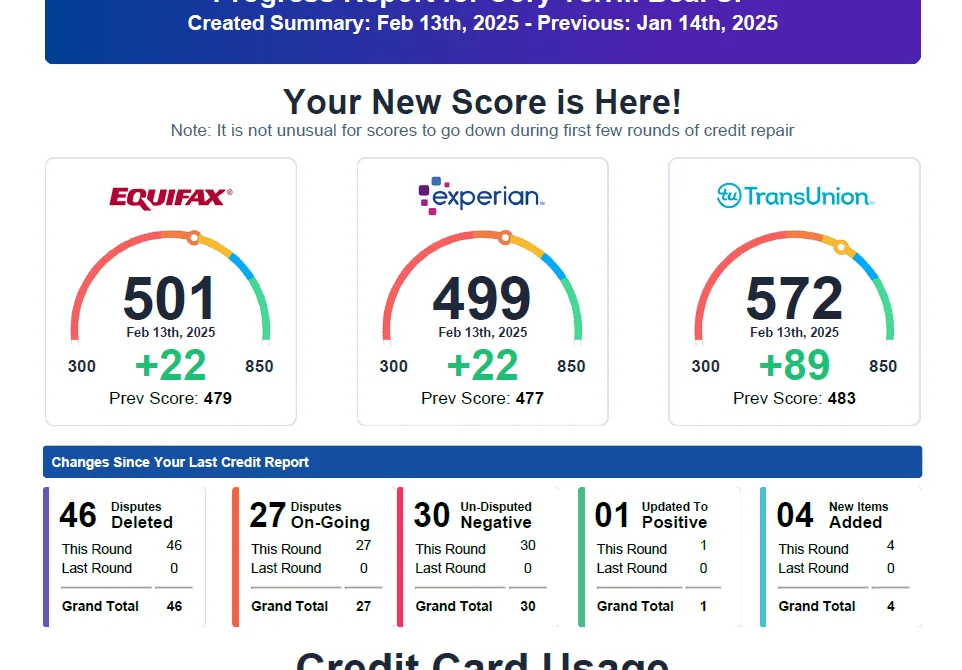

We Get Results!

Our process is proven and back by a money back guarantee if no items are successfully disputed after 90 days.

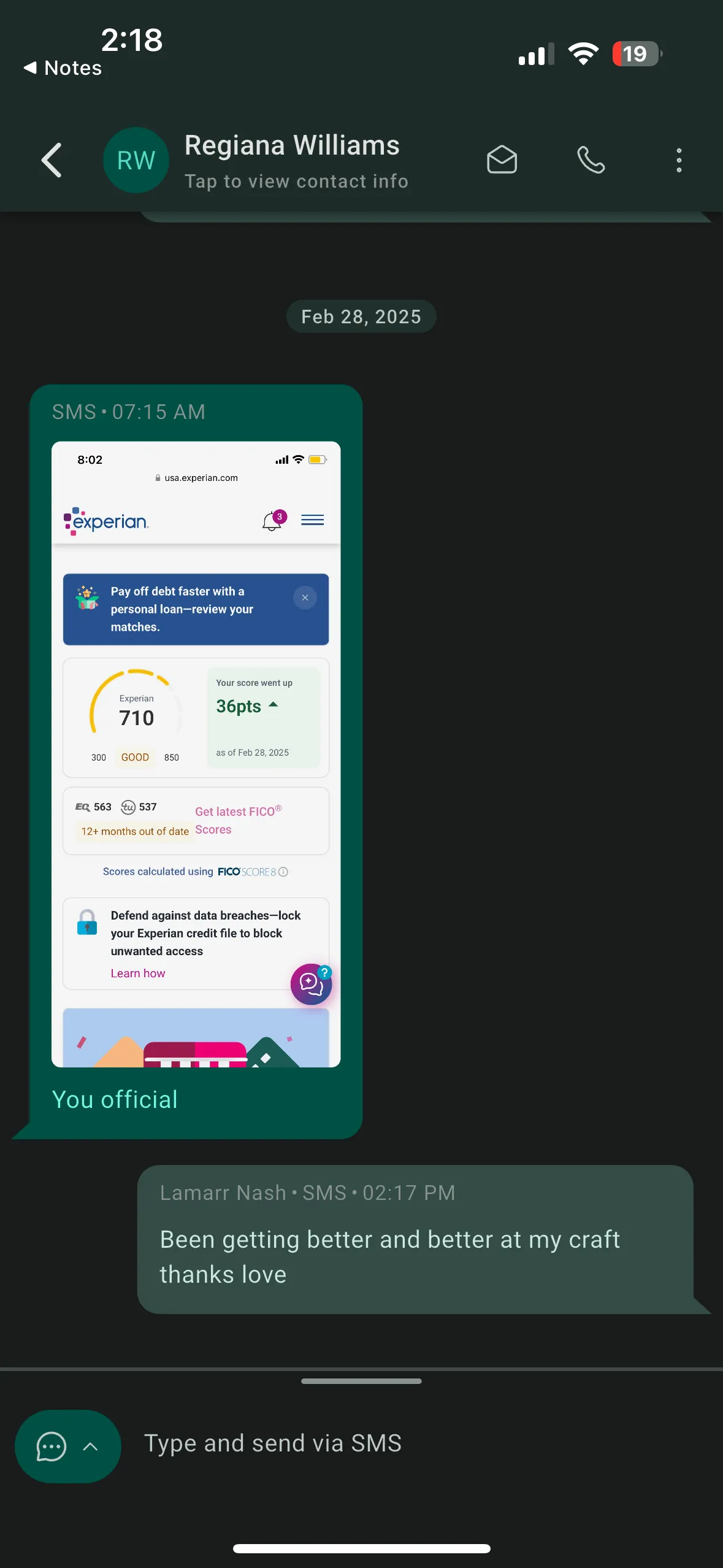

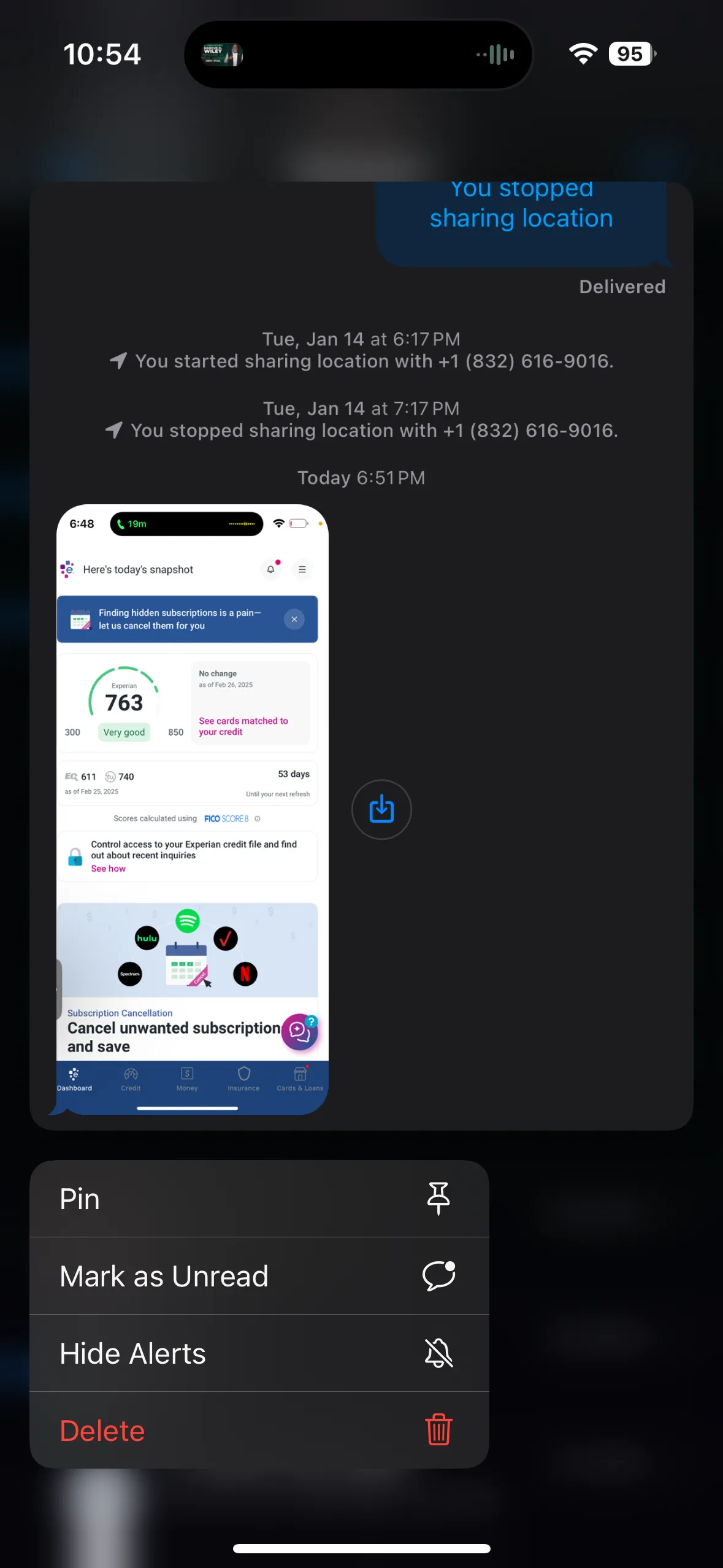

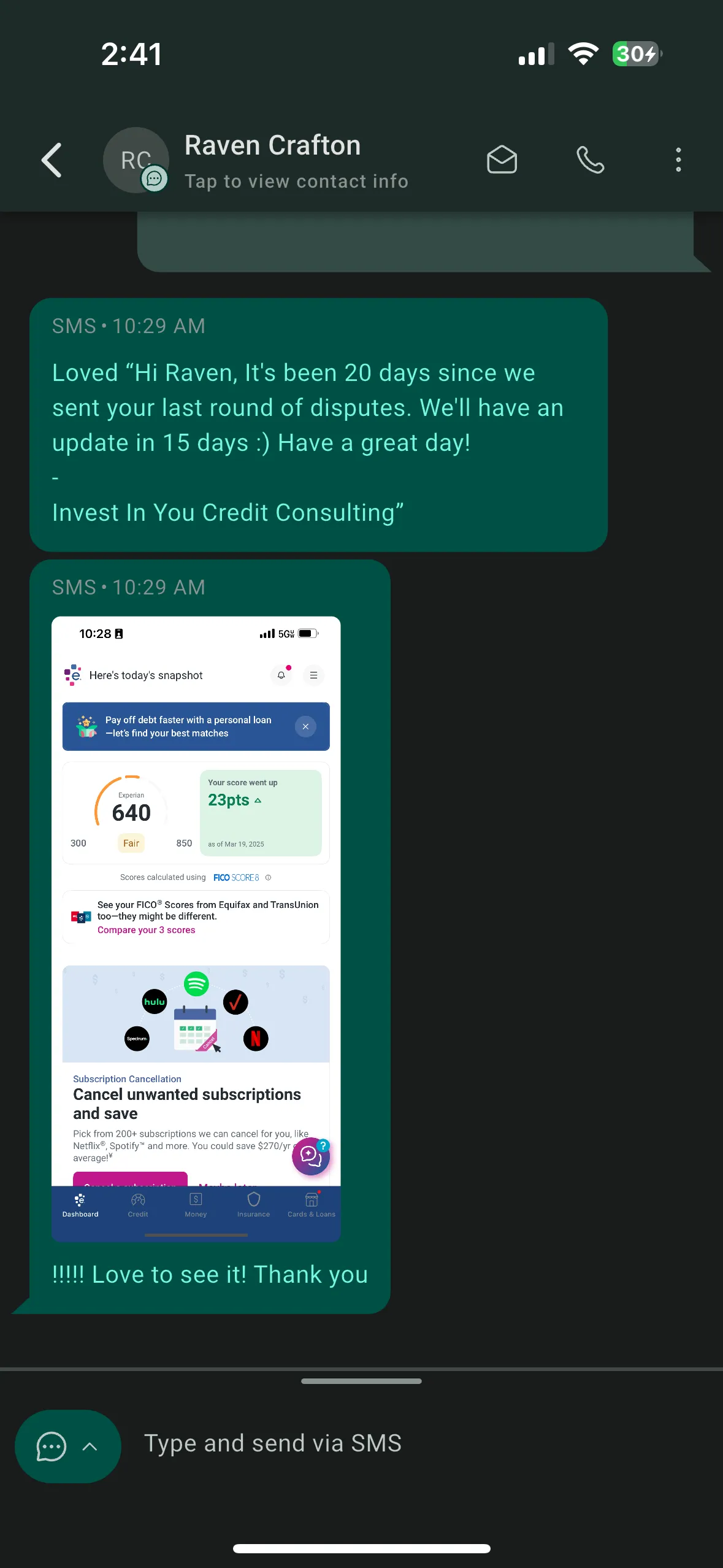

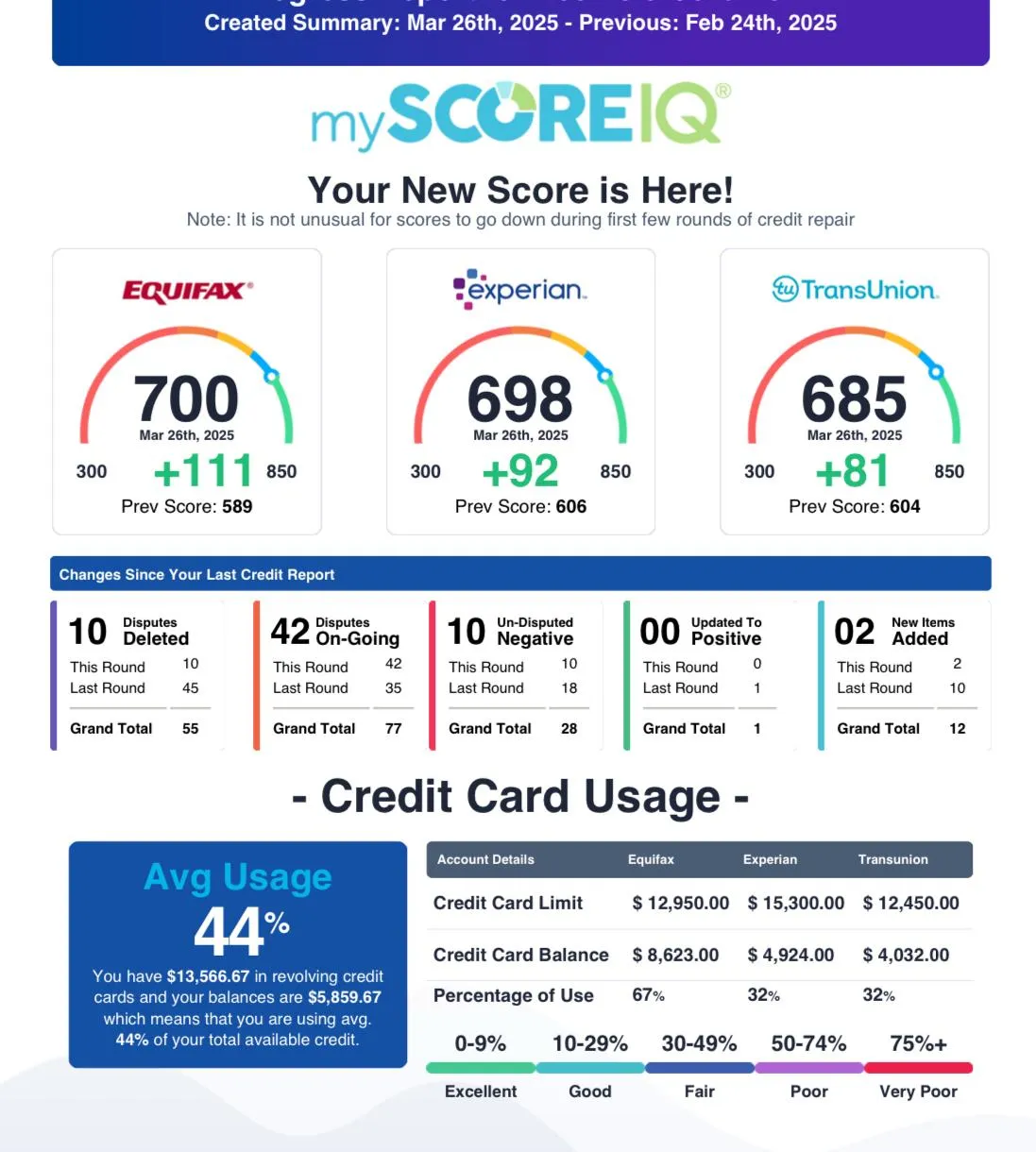

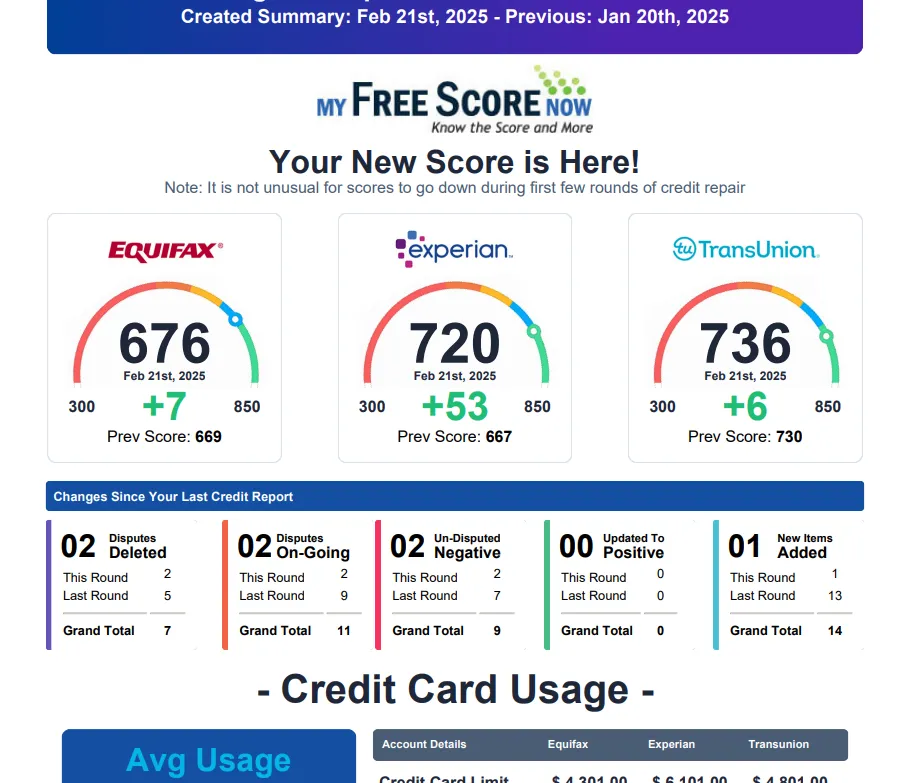

What People Say

Real People Real Results

We don’t just fix credit! WE CHANGE LIVES!

Let Us Help You Change Your Life!

Frequently Answered Questions

You Got Questions? We Got Answers

What Is Credit Repair?

Credit repair involves the elimination of inaccurate, unverifiable, or erroneous information from your consumer credit reports. Your or a reputable credit repair organization can communicate with credit bureaus, identifying and disputing any incorrect or false information on your report, and requesting its removal or adjustment.

Can I Fix My Credit Myself?

These adjustments and deletions of negative items from your credit report improve your FICO scores, leading to higher odds of approval and less interest paid.

Can You Remove Anything From My Credit Report?

We can only fight to remove any items that fall under the guidelines of the FCRA. These are items that should be removed due to being inaccurate, unfounded, out of date, false and/or erroneous.

Do I Need to Pay My Credit Cards & Loans While Receiving Credit Restoration Services?

Yes, While we are actively working on improving your credit history, it is important for you to take responsibility for protecting your credit. Adding new damage to your credit report will work against our efforts.

Is Credit Repair Illegal?

No. Credit repair is a lawful method for enhancing a compromised credit history and elevating your credit score. While you can enlist the services of a professional company to assist you in repairing your credit, they cannot accomplish anything that you cannot achieve independently.

How Long Does It Take To Repair My Credit?

We offer a guarantee that you will experience positive results within 90 days or receive a refund. Although we make every effort to promptly remove inaccurate, unfounded, out-of-date, false, and erroneous information, it’s important to note that each case is unique, making it impossible to provide an exact timeline. The duration of the process may vary depending on the number of items we need to address. Typically, the overall timeframe falls within nine months, but in some cases, it may even be shorter.

When Is The Best Time To Start?

Now! But no seriously, the recommended timeframe for credit repair depends on your specific goals. If you are planning a significant purchase, such as a new house or car, it is advisable to begin the process at least four months prior to your anticipated purchase date. credit, they cannot accomplish anything that you cannot achieve independently.

How Is lly Consulting Different From Other Credit Repair Companies?

IIY Consulting differentiates itself through its transparent business practices, personalized attention, and commitment to client success. Our team of experts will walk you through every step of the process and provide education to ensure you fully understand the services you receive.