Let’s Build

Why DO I NEED TO BUILD CREDIT?

Whether you are in the midst of credit restoration or getting your first credit card, the best way to boost your credit profile is by adding positive accounts.

The positive accounts accomplish two main goals: Counteracting Negative Information and Establishing a Good Credit History.

Click the buttons below for more details:

Credit Builders

Credit Card Builders

Kikoff

Fees: $5 to $30 Monthly

Secured: No Deposit Required

Approval Process: Soft Check for Approval

Typical Credit Limit Range: $750 - $3,500

Typical APR Range: N/A

Reports To The 3 Major Credit Bureaus

Ava Credit Builder Card

Fees: $6 to $15 Monthly

Secured: No Deposit Required

Approval Process: Soft Check for Approval

Typical credit Limit Range: $2500, But The Ability To Spend Up To $25 (or higher depending on your spend limit) on a subscription program monthly

Typical APR Range: 0% Balance is due in full 7 days after use.

Reports to the 3 Major Credit Bureaus

Petal Visa 1 or 2 Card

Fees: $0-$59 Annual Fee (Dependent on Card chosen)

Secured: No Deposit Required

Approval Process: Soft Check for Pre-Approval (Hard Inquiry Only If Accepted)

Typical Credit Limit Range: $300 – $5,000

Typical APR Range: Variable APRs range from 25.24%-34.74%

Reports to the 3 Major Credit Bureaus

Mobile App Available

Card Issued by WebBank, Member FDIC.

Discover It Secured Credit Card

Fees: $0 Annual Fees

Secured: Minimum $200 Refundable Deposit Required

Approval Process: Soft Check for Pre-Approval

Typical Credit Limit Range: $200 (Dependent on Deposit)

Typical APR Range: 28.24% Variable APR

Reports to the 3 Major Credit Bureaus

Automatic review 7 months after card issuance for possible upgrade to unsecured credit card and deposit return.

Card issued by Discover Bank Member FDIC.

Loan Builders

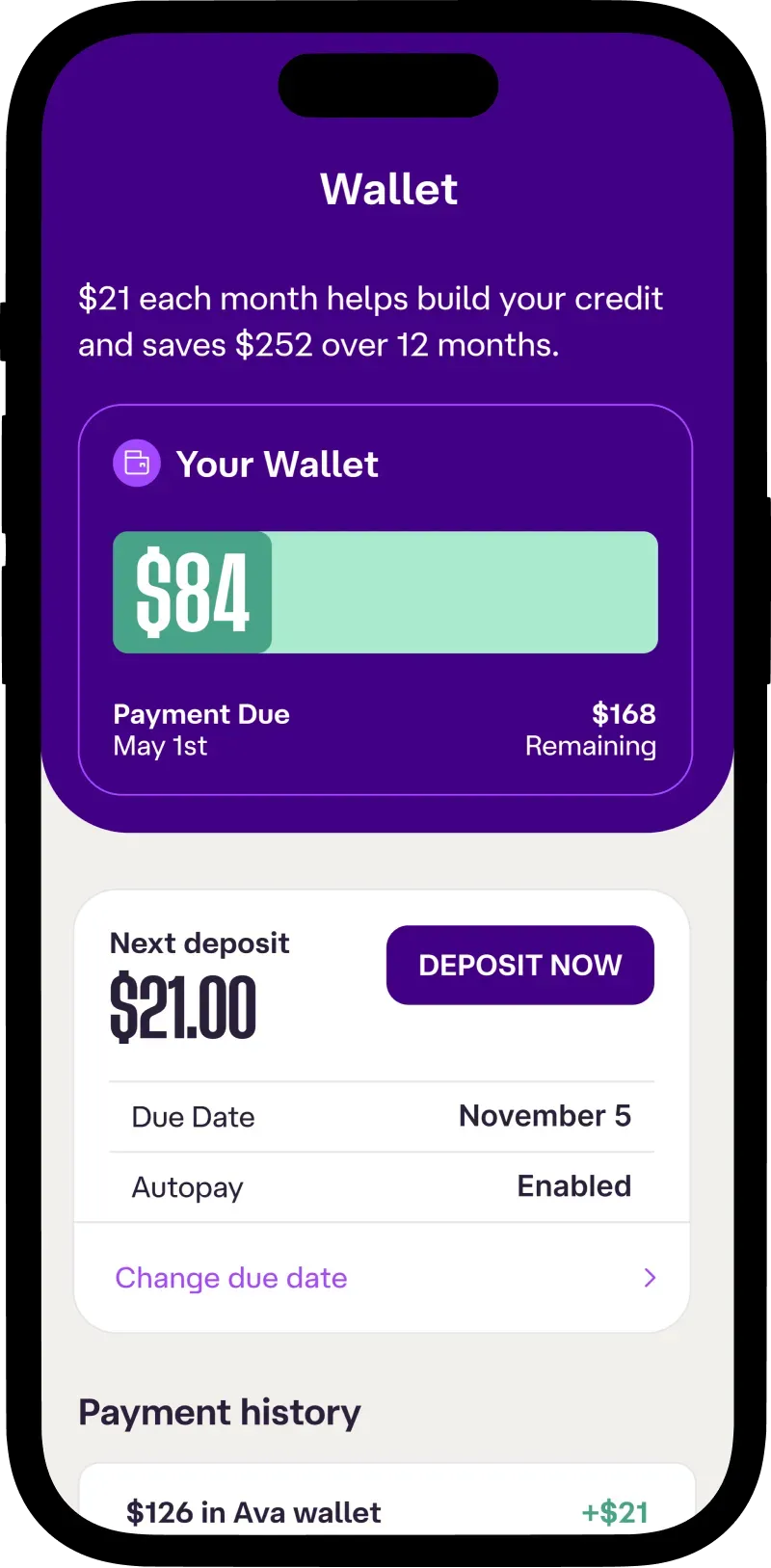

Ava Credit Builder Loan

Fees: $6-$9 Monthly Fee + $21 Monthly Savings Deposit

Secured: No Deposit Required

Approval Process: Instant Approval

Reports to the 3 Major Credit Bureaus

Time to Unlock Funds: 12 Months to unlock

Requires a Bank Account Connection for Sign Up

Kovo

Fees: $10 Monthly for 24 months

Secured: No Deposit Required

Approval Process: Instant Approval

Reports to Equifax, TransUnion, Experian and Innovis

Time to Unlock Funds: No Funds Returned. Can cancel at any time.

CreditUP By 5 Star Bank

Fees: $0 Admin Fees / Low Interest Rate

Secured: Minimum Loan Amount $500 to $1,200

Loan Term Ranges: 12 months, 18 months, or 24 months.

Approval Process: Soft Pull Credit Check

Reports to 3 Major Credit Bureaus

Time to Unlock Funds: Dependent on Term Range / Can Cancel at Anytime

Monthly Savings: CreditUp calculates your total loan amount and monthly payment. Funds from your loan will be placed in a savings account in your name.

Issued by 5Star Bank Colorado, member FDIC.

Discover It

Fees: Loan Interest rate of 5-16% / $0 Admin or Hidden Fees

Secured: Minimum Loan Amount $500 to $2,00

Loan Term Ranges: 12 months or 24 months.

Approval Process: Soft Pull Credit Check

Reports to 3 Major Credit Bureaus

Time to Unlock Funds: Dependent on Term Range / Can Cancel at Anytime

Monthly Savings: Calculated based on total loan amount and term.

All loans are made by Synapse Credit LLC, NMLS 1971454

Rent and Utility Reporters

Boom Pay

monthly Fees: $2

Past Reporting: $25 One-time fee for 24 months past reporting

Secured: No Deposit Required

Approval Process: Instant Approval

Reports to the 3 Major Credit Bureaus

Prefers a Bank Account Connection for Sign Up

Easy Mobile App

Little to No Landlord Involvement

Rent Reporters

Monthly Fees: $5 or $10

Approval Process: Instant Approval

Reporting up to $500 0r $25,000 of rent and utility payments

Secured: No Deposit Required

Reports to the 3 Major Credit Bureaus

Prefers a Bank Account Connection for Sign Up

Easy Mobile App

Bills automatically debited from checking account

RocktheScore

Set Up Fees: $48

Monthly Fee: $7 monthly afterward

Past Reporting: $65 One-time fee for 24 months past reporting

Chime

Monthly Fees: $0

Secured: Yes* money moved to Credit Builder secured account is used for building.

Approval Process: Instant Approval